Global merger and acquisition (M&A) activities have breached new highs, building on the record-breaking streak from the beginning of this year with the trend expected to continue going forward.

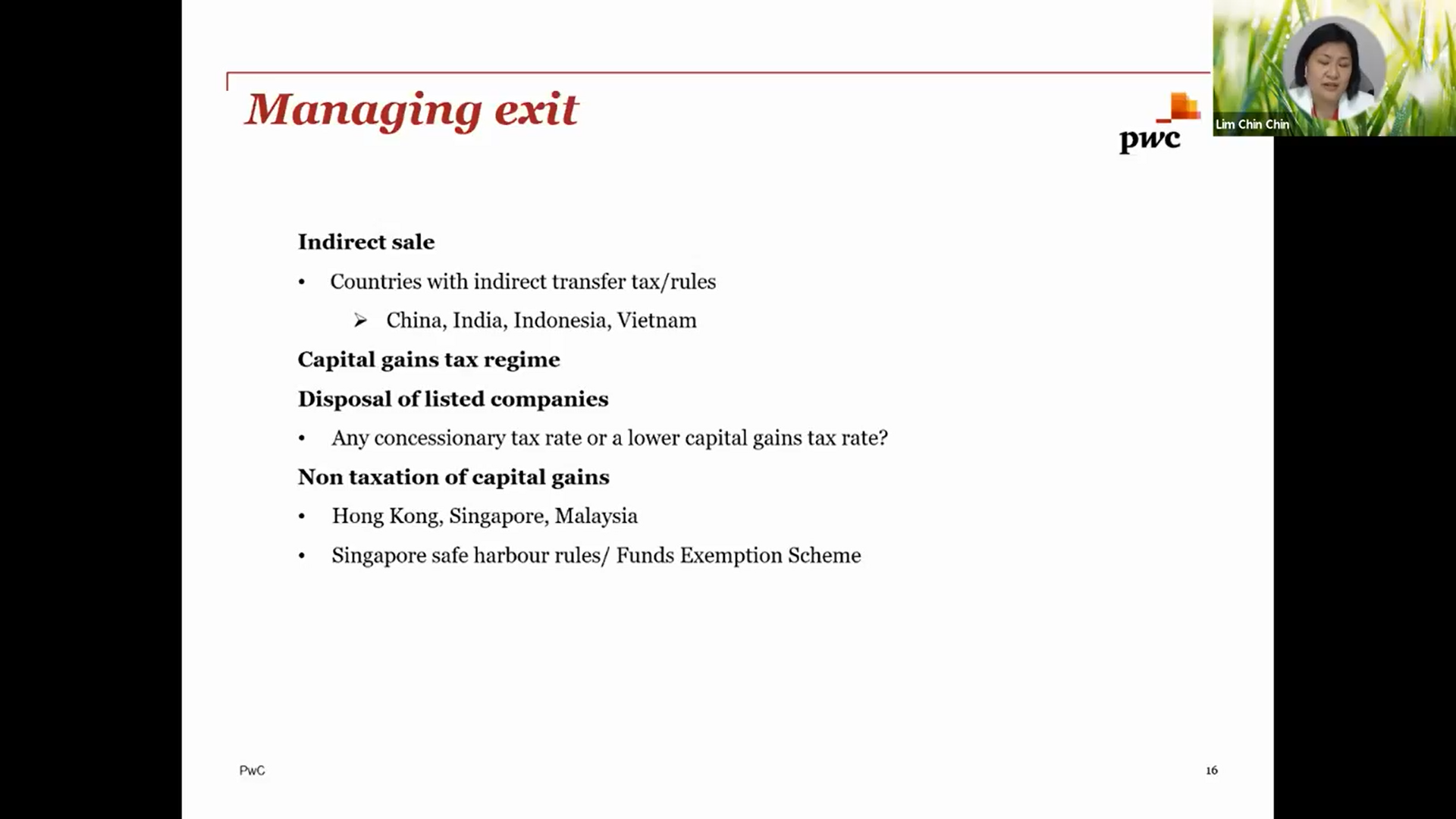

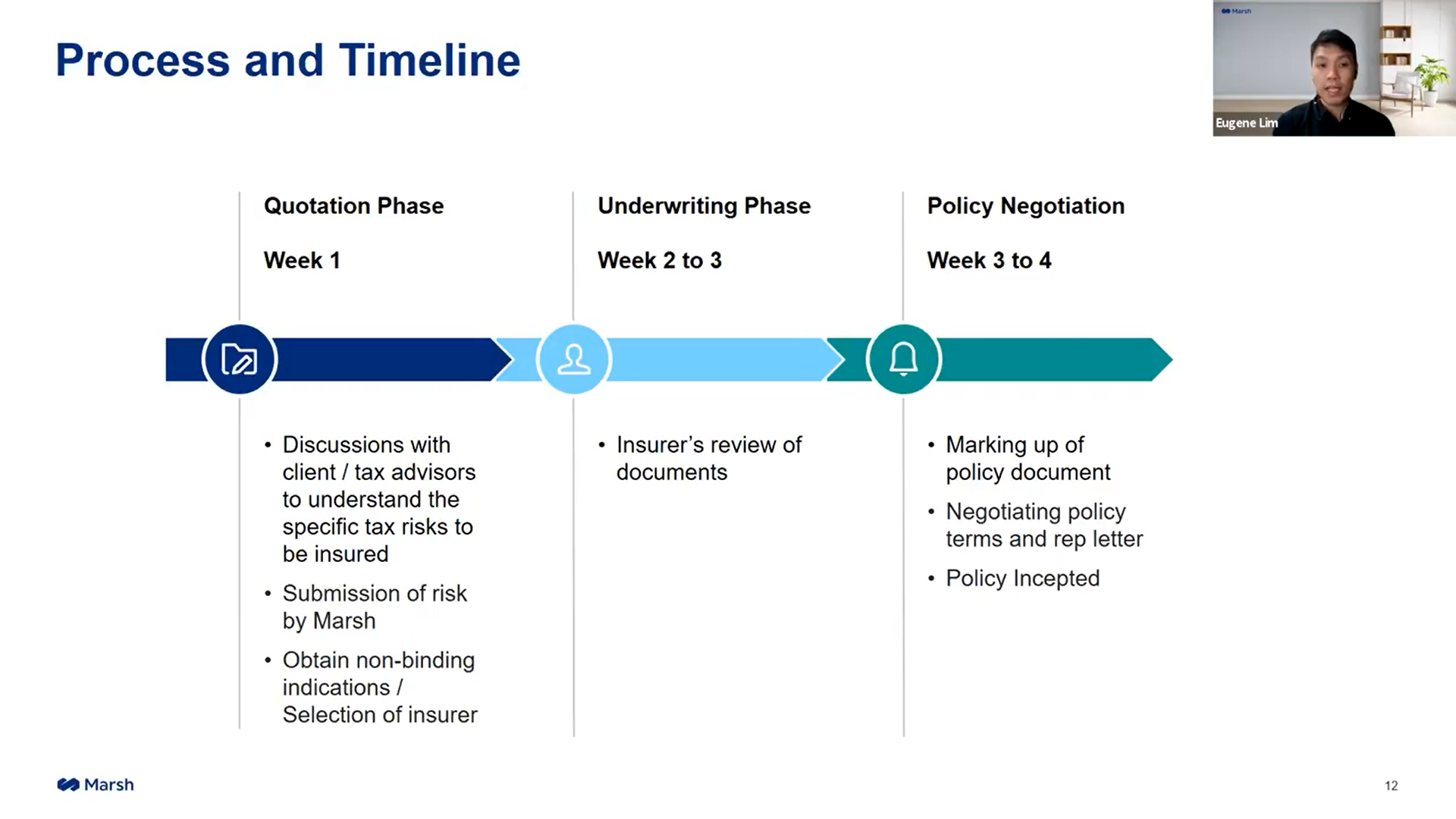

At the same time, M&A transactions are also facing a time of change due to evolving tax rules globally. Hence, tax risk is an important consideration that investors will need to take into account in order to achieve long-term value on their investments. As a result, M&A professionals are looking for new innovative solutions such as tax liability insurance to manage their tax risks arising from M&A transactions.

The Speakers of this event, Eugene Lim, Head of Tax Risk -Asia, Private Equity and M&A services at Marsh (Singapore) and Lim Chin Chin, Deals Tax Partner at PwC Singapore, shared about typical tax risks and considerations for M&A transactions in Asia and the use of tax liability insurance to manage such risks, thereby unlocking valuable cash.